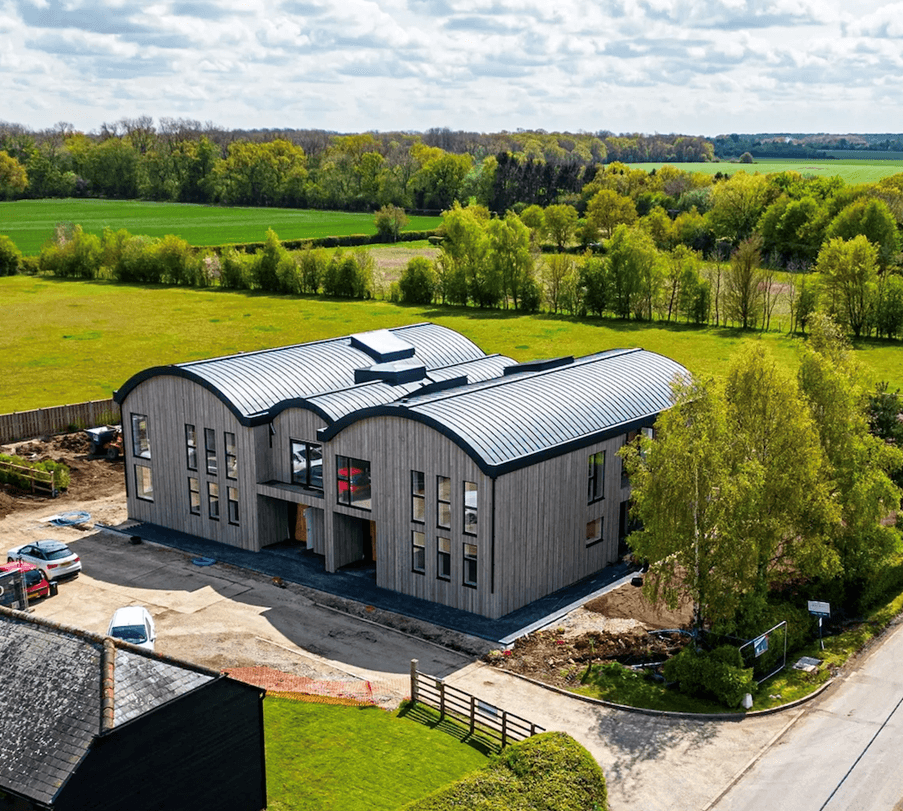

At BLEND, we recently funded the conversion of existing agricultural barns to create two self-contained semi-detached dwelling houses in Essex.

The existing property comprised a vacant derelict barn sitting on an 0.81-acre plot of land located on the eastern side of a village centre close to Saffron Walden and Bishops Stortford. The property, having been previously used for agricultural and commercial uses including as a car repair business, was a Dutch barn of steel frame with corrugated metal clad walls and roof, excellent ceiling heights and measuring circa 8,000 sq ft on a Gross Internal Area basis. There was also a barn/storage building of basic construction in block rendered walls beneath corrugated asbestos cement sheet roofs, which was planned to be demolished as part of the development works to form a 6 bay cartlodge with additional storage.

The developer had secured full planning consent for 2 new semi-detached 5-bedroom barn conversion dwellings of modern executive standard: open plan kitchen and living areas, and sufficient bedrooms and bathrooms for family use. Plot 1 was planned to extend to 3,660 sq ft plus a 947 sq ft garage, while plot 2 was planned to have 3,925 sq ft plus a 947 sq ft garage. The developer was keen in providing a better than average specification and larger than average gardens in order to offer practical outdoor entertaining space.

Design Challenges

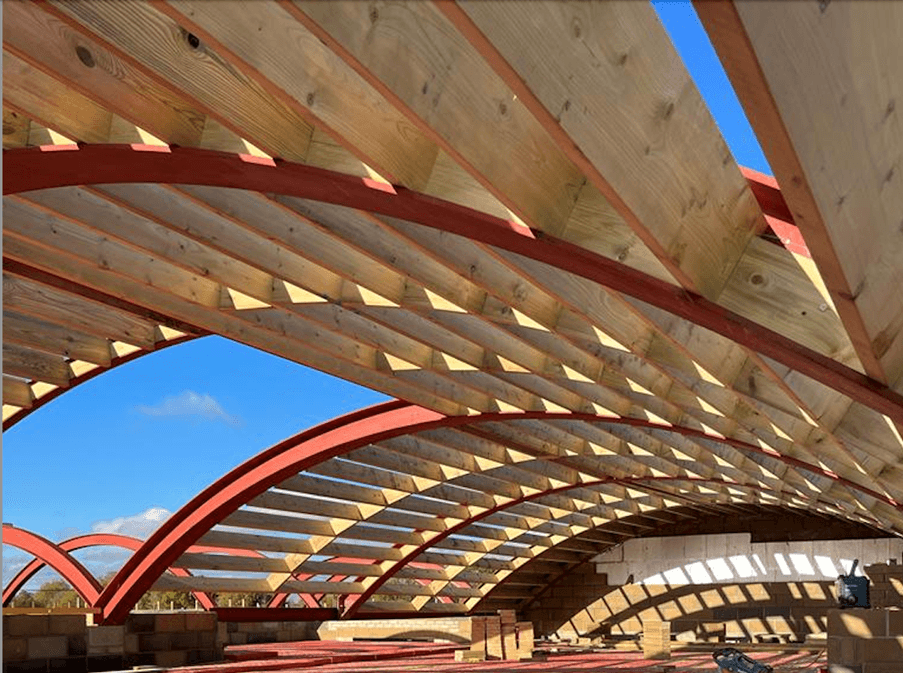

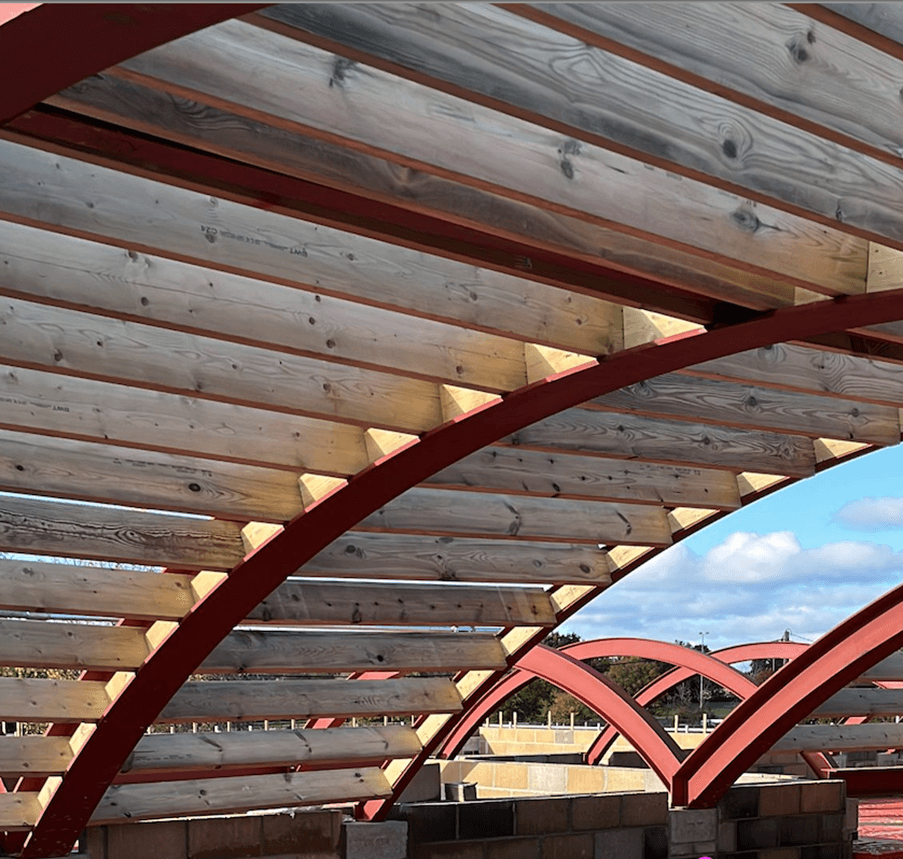

The roofs on the existing building had a three-section curved profile as shown in the pictures above and the existing structure was required to be retained by the planners. As a result, the developer was fully aware from the start of the project that there would be design challenges to overcome with the roof to ensure a cost-effective waterproof finish was achieved.

The original design provided for removal of the existing cladding and retention of the existing steel structure which was to be modified and extended to accommodate the new residential two-storey layout. On commencement of the demolition works however it was found that the existing steel structure was unsafe and could not be retained, and accordingly was removed.

The steel framework was never intended to be integral to the structure of the building and the decision was made to proceed with a conventional cavity construction structure formed off of new mass concrete foundations. Timber joists would then form the first floor. Timber joists and 22 curved steels weighing circa 15 ton would be used to create the curved roof profile between the existing and modified steel trusses. Cavity masonry would also form the party wall structure separating the two dwellings.

Externally the building would be clad with Scottish larch cladding boards and the roof would be covered with insulated aluminium sheeting with a standing seam profile. Doors and windows would be by Velfac who provide a composite aluminium clad timber double glazed unit.

This was a high specification development that incorporated many quality finishes both above and below the surface, such as standing seam roof finishes, curved vaulted ceilings, quality composite windows, a high level of bathroom and kitchen finishes, and fully integrated IT with specialist lighting, all within the large internal open spaces created by the voluminous barns.

Our appointed independent monitoring surveyors, C D Mountney Ltd., took a hands-on approach to assist the developer in putting the cost plan together to adequately address the particular design challenges that this development presented to make the draw down process as smooth as possible.

The result is as fantastic and impressive as it can be seen on the images below.

BLEND is a specialist development finance lender that works with experienced mid-sized property developers in the UK.

For more information, please visit www.blendnetwork.com or email us at enquiries@blendnetwork.com

BLEND Loan Network Limited is authorised and regulated by the Financial Conduct Authority (Reg No: 913456).

BLEND Loan Network Limited is registered in England and Wales. Registered office: Evelyn House, 142 New Cavendish Street, London W1W 6YF.

Don’t Invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.