We enter 2023 under the shadow of a global recession, significantly deeper in the UK than in other G7 countries, against a backdrop of severe inflation and rising interest rates. As a result, the environment will continue to be challenging for property, with high costs of debt, and we anticipate, lower investment volumes.

However, we believe the green shoots of economic recovery will start appearing towards the end of H1. For good developers with access to funding, there are still good opportunities for schemes that are started in 2023 and completed towards the end of 2024, especially as the outlook for housing supply looks set to deteriorate sharply.

Click below to download our January Blend Property Pulse.

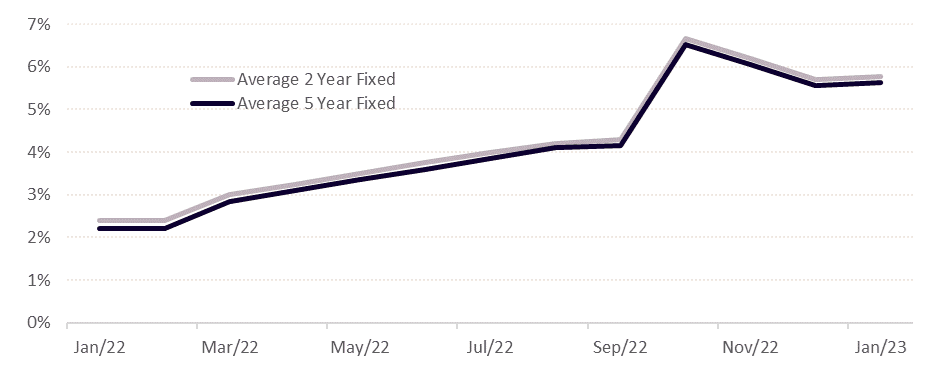

Exhibit 1: Average fixed rate mortgage prices 2022/2023

Soure: Money Facts/This Is Money, Blend

Blend is a specialist development finance lender that works with experienced mid-sized property developers in the UK.

For more information, please visit www.blendnetwork.com or email us at enquiries@blendnetwork.com

BLEND Loan Network Limited is authorised and regulated by the Financial Conduct Authority (Reg No: 913456).

BLEND Loan Network Limited is registered in England and Wales. Registered office: Evelyn House, 142 New Cavendish Street, London W1W 6YF.

Don’t Invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.